Does Low-Mileage Driving Qualify You for Cheaper Car Insurance in Utah?

Drive less than the average Utah driver? Learn how low-mileage discounts and pay-per-mile policies can help you get budget-friendly car insurance in Salt Lake City.

How much you drive can have a big impact on your car insurance rates. If you only use your vehicle occasionallywhether its for quick errands or weekend tripsyou might be paying more than you need to for coverage.

For many Utah drivers, especially those in Salt Lake City who rely on public transportation, cycling, or work from home, low-mileage discounts can be a great way to save money. But how do insurers calculate mileage, and does it really lower your premium?

How Mileage Affects Car Insurance Rates

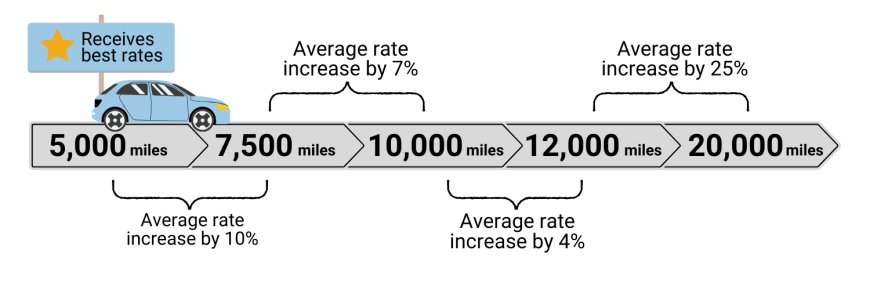

Insurance companies assess risk based on how much time you spend on the road. The more miles you drive, the higher the chances of an accident, which means higher premiums. Conversely, low-mileage drivers are statistically less likely to file claims, making them cheaper to insure.

In Utah, the average driver travels about 12,000 miles per year. If you drive significantly less than that, you may qualify for reduced rates under low-mileage or pay-per-mile policies.

Budget-friendly car insurance in Salt Lake City Utah is often available for drivers who log fewer miles annually, helping them save while maintaining essential coverage.

Types of Low-Mileage Discounts

There are a few ways insurers reward low-mileage driving:

-

Standard Low-Mileage Discount

If you report an annual mileage below a certain threshold (often around 7,50010,000 miles), your insurer may apply a discount automatically. -

Usage-Based or Telematics Programs

These programs track your driving habits using a mobile app or plug-in device. You pay based on actual mileage and safe driving behavior. -

Pay-Per-Mile Insurance

Ideal for those who drive very little, these policies charge a low base rate plus a few cents for each mile you drive.

Who Benefits Most from Low-Mileage Insurance?

Low-mileage discounts are perfect for:

-

Remote workers who dont commute daily

-

Students who only drive on weekends or during school breaks

-

Households with multiple cars but limited use for some vehicles

-

Seniors who rarely take long trips

If you fall into any of these categories, its worth checking if your insurer offers a program tailored for your driving habits.

Additional Ways to Save Beyond Mileage

Even if you qualify for a low-mileage discount, you can stack other savings by:

-

Bundling policies with renters or homeowners insurance

-

Driving a car with strong safety and anti-theft features

-

Maintaining a clean driving record

-

Shopping around for quotes at least once a year

Combining these strategies can result in even more significant savings on your annual premium.

Final Thoughts

Yes, low-mileage driving can absolutely help you secure cheaper car insurance in Utah. By proving youre on the road less often, you present less risk to insurers, which can translate into substantial savings.

If you live in Salt Lake City and drive less than the average commuter, ask your insurer about mileage-based discounts or consider switching to a usage-based plan for maximum benefits.